Download and fill out Form 8822 to notify the IRS of a change of address. A quick guide to get you through that red tape.

How To Change Your Address With the IRS

So, you’ve decided to move! Mazel tov! Moving is stressful business, even if it involves the prospect of a bigger/better/more beautiful home. You have to pack everything up; you have to decide which items to throw out; you have to hit the pavement to find that perfect new apartment or dream home; the list goes on and on!

Maybe it’s your very first move and you’re leaving your parent’s nest? Perhaps you’ve decided to move in with that special someone? Or maybe you’re moving for a new job. Maybe you got tired of water leaking from your bathroom ceiling and the building super ignoring your increasingly panicked texts as the floor became an aquarium.

Whatever the reason for your shift in locales, the process of moving involves so many things, you can often forget a critical element: filing a change of address form with the Internal Revenue Service.

THE IRS???

Yep! Change of address forms are not just for the postal service (though you really ought to get on changing that mailing address; you don’t want to miss all those amazing credit card offers from that bank you’ve never heard of).

Admittedly, in most cases, a change of address is processed through your next tax return. You just use your new address when you file it. BUT if you’ve moved after filing your tax return, but before receiving your refund, you need to take action and notify the IRS of your change of address.

Like most things government-related, this isn’t as simple as just calling up the IRS and saying, “Hey, I moved.” Technically, you can do this, but most likely, they’ll need more information and you’ll end up having to fill out a form anyway.

That’s why the best way to notify the IRS of your address change is Form 8822: the IRS change of address form.

So, to save you that step, you can fill out and download this form directly by clicking the button below.

I won’t send you off into the bureaucratic wilderness without a little walkthrough, though. I know how daunting sending anything to or through the IRS can be. Seriously, that organization knows how much money you’re supposed to pay them in taxes, but they don’t let you know? You just have to do your best at guessing, and if you get it wrong, you go to jail. Scary stuff.

Point being, let’s walk through this together so we don’t make any mistakes!

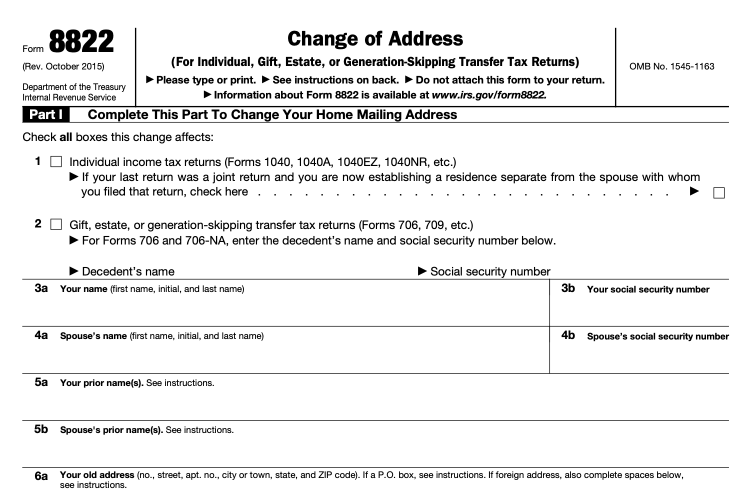

How to Complete Form 8822

Let’s take a look at Form 8822 real quick. Again, form 8822 is available for download on Smallpdf by clicking the image or button below.

First things first: this form has two parts, parts I and II. Make sure you fill out both.

Part one:

- Check the boxes that this form affects: For most everyone, that’s the first box: the individual tax return. If you previously filed a joint tax return, but are now filing separately, check the box that is all the way on the far right as well. The final box–gift tax, estate tax, and transfer tax returns–affects fewer people. You likely won’t fall into that category.

- Enter your name and your social security number into 3a and 3b, respectively.

- If applicable, fill out 4A and 4B with your spouse’s name and social security number.

- For 5A and 5B, fill out any former names for you and your spouse, if applicable.

- 6A and 6B are for your and your spouse’s old address(es). If you or your spouse were previously living abroad, make sure to include that information. There are special boxes below the address box for foreign addresses. Tip: Do not abbreviate the name of the foreign country!

- Enter your new address into field 7.

Great! That’s part one: the big part. I’d suggest you go through every line once more, just to be sure you haven’t accidentally left anything blank (unless it doesn’t apply). Once you’re sure, then move on to part two.

Part two:

- You may (but don’t have to) include a telephone number in case they need to contact you.

- Sign and date the form.

- Have your spouse sign and date the form (if applicable).

- On the right, there is space for an executor to sign. If you’re filling this out on your own for yourself or your spouse, you should leave this blank.

How to Submit the Form

If your old address was in any of these states: Alabama, Connecticut, Delaware, District of Columbia, Georgia, Kentucky, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, and West Virginia

then send your form to this address: Department of the Treasury, Internal Revenue Service Kansas City, MO 64999-0023.

If you lived in one of these states: Florida, Louisiana, Mississippi, and Texas

then you send it here: Department of the Treasury, Internal Revenue Service Austin, TX 73301-0023.

For folks who used to live here: Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, and Wyoming

The correct address to send the form to is: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0023.

For those of you living in a foreign country, such as Puerto Rico, Guam, or American Samoa; there are additional addresses that you will find on the form itself.

As a matter of fact, all the addresses are on the back (or last page) of the form. If you only print out the first page, you can use the addresses we listed here, or access the form again to make sure you got it right.

After you’ve properly addressed and stamped your envelope, drop it off in your mailbox or local post office. Your IRS change of address will be processed within 6-8 weeks.

Problem solved! Now back to choosing a uHaul model for that cross-country move!