Tax docs pile up fast. Build a clean, searchable system with scans, folders, and secure PDFs in Smallpdf to make filing way less stressful.

Tax forms shouldn’t live in random emails and filing drawers. We’ll help you build a simple system you can keep up all year.

Tax season gets messy when documents arrive from everywhere. A W-2 in your inbox. A medical receipt in your wallet. A mileage log on your phone. Then you sit down to file and spend hours hunting for that one form.

The fix isn’t complicated. You need one home for the year, clear categories, and a way to turn paper into searchable PDFs you can share safely.

We’ll walk you through a setup that works for employees, homeowners, freelancers, and small business owners.

Quick Steps To Organize Tax Documents

If you want the fastest path, do this:

- Create a master folder for the tax year.

- Scan paper into PDFs and name files consistently.

- Merge related docs into one PDF per category.

- Compress large PDFs before sharing.

- Password-protect anything with SSNs or account numbers.

How to organize tax documents

Set Up Your Tax Folder System for the Year

Start with one master folder labeled with the tax year, like “2025 Taxes.” Keep it in a place you already use, like your computer plus your cloud storage.

Inside that folder, create subfolders that match how tax forms arrive and how deductions are tracked:

- Income

- Deductions

- Credits

- Investments

- Health and Insurance

- Business or Side Gig

- Prior Years

If you’re self-employed, add one more folder called “Quarterly Taxes,” so estimates and confirmations don’t get buried.

File naming matters more than people think. Pick one format and stick to it, for example:

- ‘2025_W2_EmployerName.pdf’

- ‘2025_1099NEC_ClientName.pdf’

- ‘2025_Charity_Receipt_Organization.pdf’

- ‘2025_Mileage_Log_Q1.pdf’

This makes search work like a shortcut. If your accountant asks for ‘all 1099s,’ you can type ‘2025_1099’ and pull them in seconds.

Turn Paper Into Searchable PDFs

Paper is still part of tax life. Medical receipts, donation letters, and small business purchases often start as paper. The goal is to digitize quickly, then stop handling the same slip five times.

Step 1: Scan With Your Phone

If you’re scanning from a phone, Smallpdf PDF Scanner lets you scan to PDF and use OCR to make text searchable.

- Open the app and choose “Scan with camera.”

- Capture the document, then crop and straighten it.

- Save it as a PDF into the right folder.

Step 2: Make Scans Searchable With OCR

Searchable PDFs save you later. You can find ‘HSA,’ ‘mortgage,’ or ‘tuition’ with a quick search instead of scrolling page by page. Smallpdf supports OCR to turn scans into searchable text.

Step 3: Combine Loose Pages Into One File

Receipts love to multiply. Instead of sending fifteen separate PDFs, combine related items into one file. Smallpdf Merge PDF helps you combine multiple PDFs into a single document.

Combine loose pages into one file with Merge PDF

A good rule is one PDF per category per year, or one PDF per quarter if you’re tracking business expenses.

Keep Receipts and Expenses Organized All Year

Receipts matter most when they support deductions or business expenses. The easiest approach is to sort them while they’re still fresh.

If you’re an employee, you might only need a few categories. If you freelance or run a small business, you’ll need consistent tracking.

Use receipt groupings that match real life:

- Medical and pharmacy

- Charitable donations

- Education and childcare

- Home and property

- Business expenses

- Travel and mileage

Here’s a real example that keeps things simple. A freelancer who gets paid by three clients can create a ‘Business’ folder with subfolders for ‘Income,’ ‘Subscriptions,’ ‘Equipment,’ and ‘Travel.’ Every month, they drop receipts into the right place and scan paper the same day it arrives. That’s it. No end-of-year panic.

Build a Routine That Fits Your Work Style

Your system only works if it’s easy to maintain.

Try one of these rhythms:

- Monthly, for W-2 employees and homeowners

- Twice a month, for freelancers with frequent expenses

- Weekly, for businesses with high volume receipts

A simple monthly reset looks like this:

- Download new forms from email or portals.

- Scan any paper receipts still sitting around.

- Rename files so they match your format.

- Merge loose pages into one PDF per category.

- Back up the folder to cloud storage.

If you do this for ten minutes a month, tax filing becomes a review step instead of a scavenger hunt.

Share Tax Files With an Accountant Without the Mess

Accountants love clean inputs. They don’t love screenshots, random photos, or twenty email attachments with no labels.

When you’re ready to share:

- Merge documents by category so they open as a single PDF.

- Compress big filesso email or portals don’t reject them. Smallpdf Compress PDF offers options designed to reduce the size while keeping the quality readable.

- Password-protect anything sensitive before you send it.

Digital Security Best Practices for Tax Documents

Tax documents include SSNs, addresses, employer info, and bank details. Treat them like a wallet, not like casual files.

A solid baseline includes:

- Use a password manager for long, unique passwords.

- Turn on two-factor authentication for cloud storage.

- Limit sharing permissions to specific people.

- Store a backup copy in a separate location.

- Lock PDFs before sharing, especially over email.

Smallpdf Protect PDF uses AES 128-bit encryption to password-protect PDFs. Smallpdf also uses TLS encryption during file transfer and maintains ISO/IEC 27001 certification, along with privacy compliance measures.

If you want the full breakdown of our security posture and file handling, our safety overview explains file deletion timing and core protections.

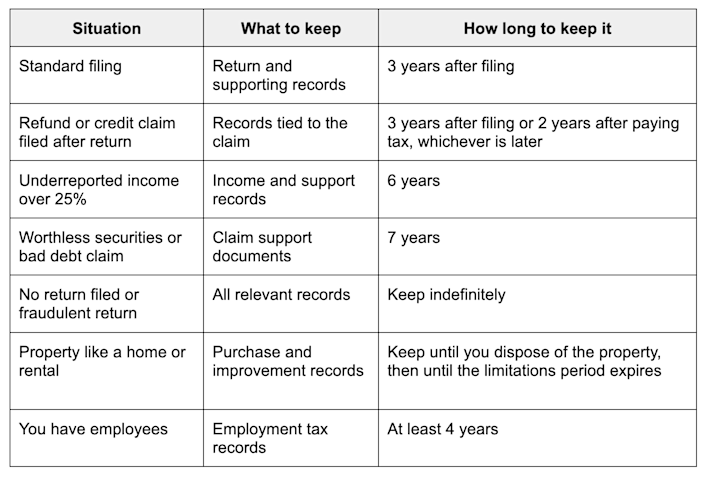

How Long To Keep Tax Documents

Retention depends on what the document supports. The IRS outlines different timelines based on your situation, including longer windows for underreported income, loss claims, and property records.

Use this table as a practical reference.

How long to keep tax documents

A simple way to apply this is by folder rules. Keep most categories for at least three years. Keep property records in a ‘Home and Property’ folder until after you sell, plus the required period after that.

Get Your Tax Files Under Control Before the Deadline

If you start with one folder, consistent file names, and searchable PDFs, tax prep gets calmer fast. Scan new paperwork as it comes in, merge and compress before you share, then password-protect sensitive files when they leave your hands.

Frequently Asked Questions

How do I organize tax documents for my accountant?

Create folders by category and name files consistently. Merge related documents into one PDF per category, then compress and password-protect before sharing.

What receipts should I keep for taxes?

Keep receipts that support deductions or business expenses, like medical costs, donations, and work-related purchases. Scan and file them as soon as you can so they don’t disappear.

How long should I keep tax documents?

For many situations, three years after filing is the baseline. Some cases require six years, seven years, or longer, and property records need special handling.

Can I throw away old tax returns?

Once the relevant retention period passes, you can dispose of them securely. For paper, shred. For digital, delete the file and empty trash, then remove old backups too.

What’s the best way to organize receipts for a small business?

Separate business expenses from personal spending. Track expenses by category, keep mileage logs, and save quarterly tax payment confirmations in their own folder.

Should I keep digital or paper copies of tax documents?

Digital copies are easier to search, back up, and share. Keep paper originals when you’re required to, or when the document has legal value beyond taxes.

How do I organize tax documents if I’m self-employed?

Track income and expenses by quarter, not just by year. Keep 1099s, invoices, and expense receipts in a ‘Business’ folder, plus a ‘Quarterly Taxes’ folder for estimates and confirmations.

What happens if I lose my tax documents?

Start with the issuer. Employers can reissue W-2s, platforms can regenerate 1099s, and banks can provide duplicate statements. Rebuild your folder as you receive replacements so the gap doesn’t repeat.