- CompressConvertAI PDF

- Organize

- View & Edit

- Convert from PDF

- Convert to PDF

- SignMoreScan

- Home

- ›

- ›W-9 Form for 2026—Free Template To Fill Out in Seconds

W-9 Form for 2026—Free Template To Fill Out in Seconds

All the information independent contractors need regarding the W-9 form. Plus, an editable W-9 form template you can edit and print out right away.

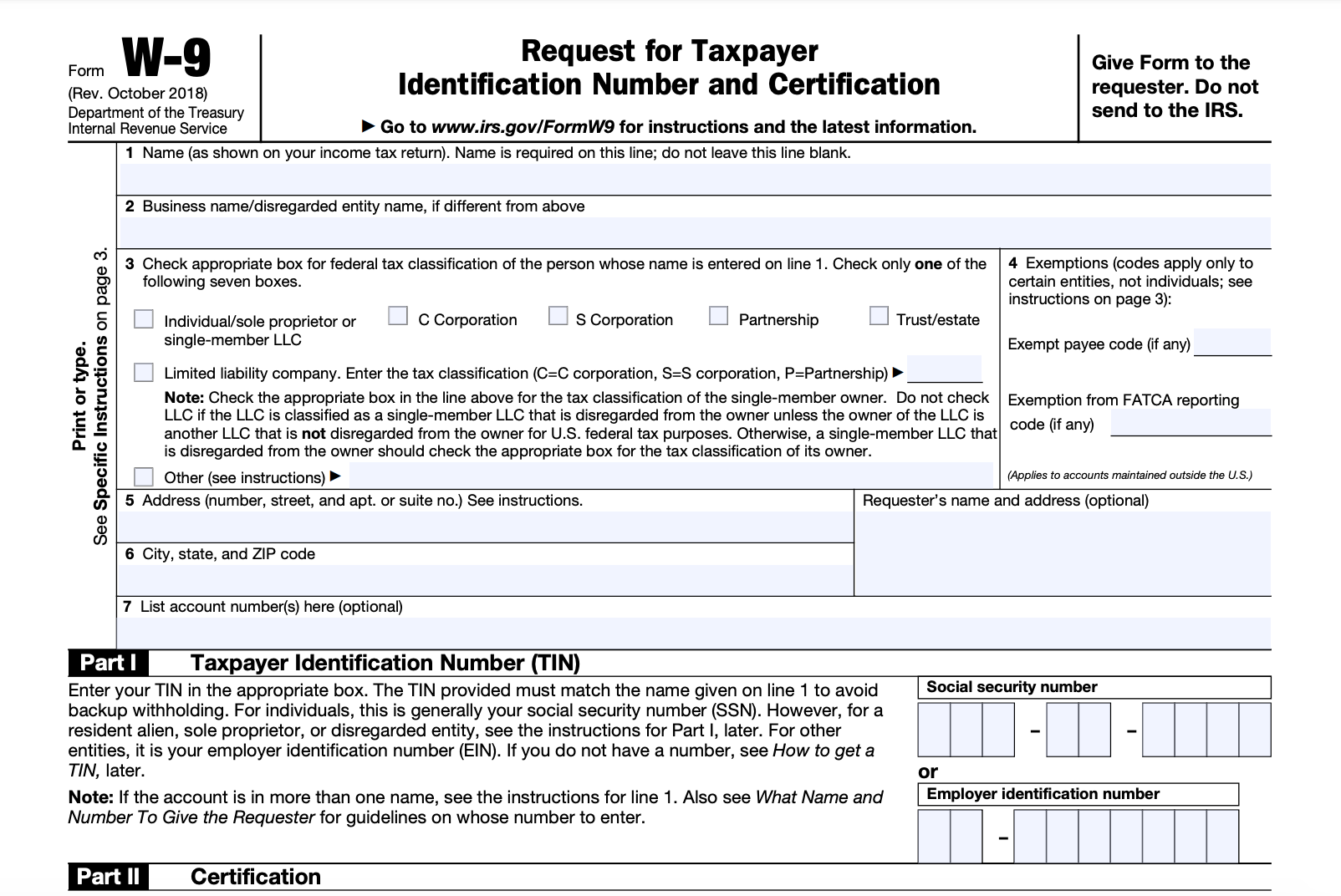

How To Fill Out the IRS W-9 Form Online

Open the free W-9 template.

Enter your name, business name, and address in the corresponding boxes.

Check the appropriate box for the federal tax classification—whether you’re a sole proprietor/single-member LLC, a C corporation, S Corporation, in a Partnership, or a Trust/Estate.

Fill out your Social Security Number or Employer Identification Number.

Sign and date the form.

Click “Print” or “Download” to save the W-9 as a PDF.

Breaking Down the W-9 Form

Unlike many other tax forms, the W-9 is relatively easy to fill out. As an independent contractor, you may not be used to the process or the lingo, though. We’ll go into each section of the IRS form in further detail below to help you get this paperwork out of the way as fast and easily as possible.

1: Name

If your business is a sole proprietorship or a single-member LLC, and is taxed as a sole proprietor or single-member LLC, your full legal name will go on this line. This name should match the one that appears on your tax return. On the other hand, if the LLC is a partnership, an S corporation, or another type of LLC, then insert your business’s name on this line.

2: Business Name/Disregarded Entity Name

You only need to fill out this section if you’re filling out the W-9 as a single-member limited liability company or a sole proprietor. So, if in line 1 you entered your legal name, the name of your business will go on this second section. If there is a DBA (Doing Business As), you can also put it here. Conversely, if the first section contains your business’s name or you work under your name, then you should leave this section blank.

3: Federal Tax Classification

This section of the W-9 refers to your tax status. Again, tick “Individual/sole proprietor or single-member LLC” if your business is a sole proprietorship of your company. The same goes for if your LLC is a C Corporation or an S Corporation. On the other hand, if another LLC owns the LLC, tick the “Limited Liability Company” box, and designate whether the parent company is a C corporation, an S corporation, or a Partnership by putting in C, S, or P, respectively.

4: Exemptions

This segment is for small businesses that are exempt from backup withholding or FATCA reporting. Write down the exempt payee code or exemption from FATCA reporting code here. Most will leave this section blank. However, if you are unsure, please check with a certified public accountant (CPA) or an advisor from a financial institution if you need assistance on this topic.

5 + 6: Address, City, State, ZIP Code

These two sections simply contain your address. If your home address is different from your business address, use the address that would be in your tax return.

Part I: Taxpayer Identification Number (TIN)

Here, put your Employer Identification Number (EIN), if you have it. In case you are the sole proprietor of your business, you would put your Social Security Number instead. Remember that you only need one of the two.

Part II: Certification

In Part II, you’ll find some information stating that by signing the W-9, you certify that the tax identification number provided is accurate, you are not subjected to backup withholding, you are a US citizen or other US person, and that the FATCA code, if any, is correct.

Once you’ve completed filling out the W-9 form, you just need to sign the document and insert the date where it is needed.

Filling Out the W-9 Form with Smallpdf

With our online PDF Editor, we have made sure you’ll find the latest version of the W-9 form from the IRS website (for the 2026 tax year) for you to work on. Right after accessing the web tool, you can start to fill out the blank W-9 by clicking on each box and entering your personal information. For the signature section, click “eSign” in the Mark up section to create and insert an electronic signature. Additionally, you add a textbox to enter additional data onto the document. Of course, the document you create by entering your data is only accessible by you. We only offer the template you work from—no personal data you enter will be visible to anyone else accessing the W-9 form on our site.

If you’d like to print the form out to fill it out with pen and paper instead—click the file menu located on the right-hand side of the Smallpdf logo at the top left corner. From there, you’ll be able to print the blank and fillable W-9 form to complete manually. You may also download the blank template to save on your computer and fill out later.

What is a W-9?

Throughout the United States, the end of the year and tax season means that all independent contractors, freelancers, and self-employed people must complete a W-9 form. When you receive compensation greater than $600 in a financial year for your work for a client, they’d need to report to the IRS what they paid you as part of their tax return.

To do so, they’ll ask for a Request for Taxpayer Identification Number and Certification, or W-9 for short, from you, the independent contractor. They’ll receive your Taxpayer Identification Number (TIN) for income tax purposes through this W-9 form. In return, you’ll get a 1099-MISC form from them, which you can use to file your tax return. The process to fill out the W-9 is relatively simple and involves five simple steps. Smallpdf hosts the W-9 2026 form through our PDF Editor, so you can fill this form out online using our free service. Afterward, you can print or save the completed form on your computer or mobile to send to your client.

How To Send the W-9

If you’re looking to send a blank W-9 to an individual contractor you’ve worked with to request their tax information, you have a few options to choose from. You can download the blank form and then share it via email or by printing it out and handing it over. You can use our sharing options to either create a link to the Smallpdf document or send an email directly through Smallpdf. Or you can save a copy of the form to your or their Google Drive or Dropbox.

If you’re the contract worker or freelance, you can send the form back securely via several methods once you’ve filled it out. Of course, this would depend on how your client wants to receive the document. You either print the completed form out, post it, or email it to the responsible department at your client’s business. Of course, you can also share the form using Smallpdf, as described above. Either way, always remember to download the filled-out document to save a copy, as we remove uploaded documents after one hour of processing, unless you used the email or link-sharing options. In the case of the latter, we keep the document available so it can be accessed through the shared link. Still, having a copy of the file just in case is a safe way to go.

Other Things to Consider

The W-9 form should be reviewed and amended every tax year or whenever any of the information provided on the form changes (your name, business name, address, or EIN). Your client will use the information presented by you, the independent contractor, to provide your 1099-MISC form. As you’ll later need to use the information provided on the 1099 detailing the amount paid to you to file your tax return, it is your responsibility to keep this information up to date to ensure quick and efficient tax filing.

Our PDF form filler is free for limited use online without the need to register an account. If you need further support relating to PDF documents, feel free to check out our collection of free tools via our homepage, where we offer functions to compress, convert, and even create digital sealing for your PDFs. Our platform assists millions of users every month, many of who are small business owners, freelancers, or contract workers, by simplifying their work with digital documents.

Fill out the W-9 form for 2026 in your browser

Related Articles