You can share your bank statement in some cases. Learn how to redact sensitive information, and keep control with secure access from start to finish.

Someone just asked for your bank statement, but is it actually safe to share? It depends on who’s asking and how you send it.

Yes, you can share your bank statement with someone, but only with trusted entities for legitimate purposes like loan applications, rental agreements, or tax filing.

In this guide, we’ll explain when it‘s okay to share your bank statement, when to think twice, and exactly how to protect your PDF before sending it.

We’ll also show you how to edit or redact sensitive bank info and share it securely.

Can You Share Your Bank Statement With Someone Safely?

You can safely share a bank statement when the request is legitimate, the recipient is trusted, and you protect the file before you send it.

Always slow down and check these three things first:

- Confirm who is asking and why they need it.

- Remove information they don’t actually require.

- Protect the PDF and use a secure sharing method.

Why Sharing Bank Statements Can Be Risky

Bank statements reveal much more than your balance. Anyone who sees them gets a detailed view of your life and finances, which can be abused for fraud or identity theft.

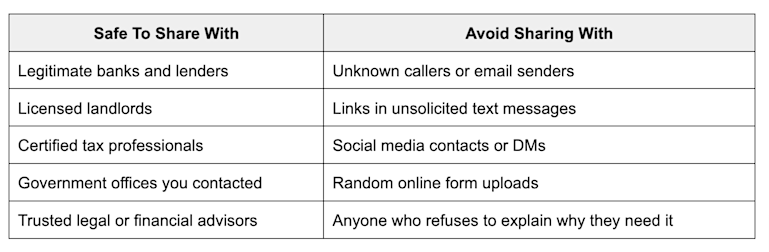

Here’s a quick view of safer versus risky sharing situations.

Why sharing bank statements can be risky

Even in ‘safe’ cases, you should still redact unneeded details and secure the PDF before sending it.

Common Situations When You’re Asked To Share A Bank Statement

You’ll usually see these requests during financial or legal checks. Knowing the typical scenarios helps you spot when something feels off.

Common legitimate reasons include:

- Loan or mortgage applications, to confirm income and spending

- Rental applications, so landlords can assess affordability

- Visa or immigration processes, to prove available funds

- Insurance claims, to verify payments or losses

- Employment checks, for income verification in limited cases

If a reason doesn’t fit one of these patterns, ask more questions before you send anything.

How To Safely Share a Bank Statement as a PDF

The safest workflow is simple: Redact, protect, then share. Here’s how to do that with Smallpdf.

Step 1: Redact Sensitive Details in Your Statement

First, remove anything the recipient does not truly need to see.

Open your statement in our Redact PDF and follow these steps:

- Upload your bank statement as a PDF.

- Drag over account numbers, personal IDs, or private notes.

- Use pattern search to find items like email addresses or phone numbers.

- Check every page to make sure no sensitive data remains.

- Click “Apply redactions” to permanently remove the text.

Redact sensitive bank information

Once redacted, the hidden information is removed from the file itself, not just covered visually.

Step 2: Add Password Protection to the PDF

Next, lock the cleaned statement so only the right person can open it.

Use Protect PDF and:

- Upload your redacted statement.

- Set a strong password with at least 12 characters.

- Mix numbers, lowercase, uppercase, and symbols.

- Confirm and apply the password.

- Save the protected PDF to your device.

Share the password over a different channel, for example, by phone or secure chat, not in the same email as the attachment.

Step 3: Share the File Through a Secure Link

Instead of attaching the PDF directly to an email, use a secure link that you control.

With Share Document, you can:

- Upload your password-protected PDF.

- Generate a time-limited or view-limited link.

- Send the link to your recipient by email or chat.

- Revoke access if it’s sent to the wrong person.

Safely share your bank statement

This gives you more control than a regular attachment and reduces the risk of the file being forwarded indefinitely.

What Information Is Safe To Share on a Bank Statement?

Not every detail on a statement is equally sensitive. Sharing less is usually safer, as long as you still meet the request.

Details That Are Usually Safe To Share

These items are often needed for loans, rentals, or official checks:

- Your full name

- Bank name and last four digits of the account

- Statement period and dates

- Incoming salary or regular income deposits

- High-level income and balance information

If someone only needs to see that you can cover rent or repayments, this is usually enough.

Details You Should Keep Private

These items create real risk if they leak:

- Full account and card numbers

- Routing numbers, unless explicitly required

- Any PINs, security codes, or login hints

- Highly detailed spending notes or merchant IDs

- Extra personal notes you wrote on the PDF

If a recipient insists on full account details, ask why and request a more limited alternative if possible.

Extra Privacy Steps Before You Send a Statement

If you handle bank statements often, adding a few extra checks makes a big difference over time.

Before you hit send, try to:

- Save a redacted copy and keep the original offline.

- Use Smallpdf to generate a fresh PDF copy to strip hidden metadata.

- Avoid storing statements in shared folders longer than needed.

- Confirm how the recipient stores, shares, and deletes documents.

- Ask for written confirmation that your statement will not be reused.

You stay in control when you decide what version of the document exists outside your own devices.

Share Bank Statements Safely With Smallpdf

Sharing a bank statement does not have to feel risky when you control what is visible and how the file travels.

With our Redact PDF, Protect PDF, and Share Document features, you can remove sensitive details, lock the file, and send it through a secure, time-limited link in just a few minutes.

Use the same simple workflow each time you are asked for a statement, and you’ll keep your financial data safer while still giving partners and providers what they need.

Frequently Asked Questions

Are bank statements safe to share?

They can be safe if you share them only with trusted, verified recipients for clear reasons. Always redact sensitive details and secure the PDF before you send it.

Is it okay to share a bank statement PDF?

Yes, as long as the PDF is redacted, password-protected, and shared through a secure channel. Avoid sending unprotected statements as plain email attachments.

What is the safest way to send bank statements?

The safest flow is to redact the PDF, protect it with a strong password, then send it through a secure link. Share the password through a separate channel.

What should I hide when sharing a bank statement?

Hide full account and card numbers, routing numbers, PINs, and any sensitive notes. Only leave the minimum details needed for the purpose of the request.

Can someone take money from my account with just a statement?

They usually cannot move money directly with only a statement, but they can use the data for scams, fake support calls, or identity theft. That is why redacting and protecting the file is so important.

Should I send a screenshot of my bank statement instead of a PDF?

Screenshots are harder to secure, harder to redact properly, and can reveal notification details. It is safer to download the PDF, redact it, and share that version.

How long should someone keep my bank statement?

For most checks, they should only keep it as long as the process is active, like a loan review or rental screening. You can ask them to delete it once the decision is made.